Malcolm Jenkins is Defining the Modern Business Athlete

Former slave and courageous abolitionist Fredrick Douglass once said, "Some men know the value of education by having it. I know its value by not having it." Malcolm Jenkins wants to help the modern minority athlete understand the complexities of investing and being financially literate with the money they earn.

BROAD STREET VENTURES

New Orleans Saints veteran safety Malcolm Jenkins founded Broad Street Ventures (BSV), the venture capital fund he co-founded in 2020. BSV has several NFL players, including Duron Harmon, Jacoby Brisset, Devin and Jason McCourty, Rodney McLeod, and Jordan Matthews. The professional athletes joined Jenkins to create the investment venture funded by Black and Brown investors. In the Forbes article, Jenkins shared the purpose of Broad Street Ventures is to "focus on giving people of color more control over their financial future."

The investment vehicle will address the need for most minorities and people of color to be in "control over their financial future," said Jenkins.

Ralonda Johnson is the general partner and co-founder of Broad Street Ventures with Jenkins. Manhattan Venture Partners' Rashaun Williams has become an advisor for Jenkins, Johnson, and Broad Street Ventures. Williams' VC group manages a fund worth over $300 million.

Jenkins spoke with CBS News about the racial divide in the venture capital industry and spoke about his vision:

"Athletes and entertainers, a lot of the time we're focused only on labor, and what we can, what we can make off our talents. But when we look at everybody else who really making money, they're doing it through passive income, not about their labor, but from other investments.

And the one thing that we have is social capital, right, the ability for brands to want to align with, and traditionally that's been in an endorsement type of relationship, I think you see a wave of athletes who are more interested in equity play. And so for us we understand that we have more power and more leverage when we do that together so creating passive ventures refers to collectively use our social capital to get into some of these quality deals, alongside of the other top 20 VCs are making all their return.

The second part of that we can be very intentional into enough spaces for African Americans and people of color to get into somebody to do. And one of the reasons that you know we formed the fund is because I think we're the first ones to do it and it's completely funded by black and brown athletes because they managed by black and brown folks.

So for us, Lana Johnson is our general partner along with Eric Campbell, she's one of the very few black women, who's in charge of a fund in this space. So we're very intentional about who we put in what position and how we get into deals knowing that there are very few people that look like us, well once we get ourselves in the door, hopefully we properly open for others to follow suit." Malcolm Jenkins

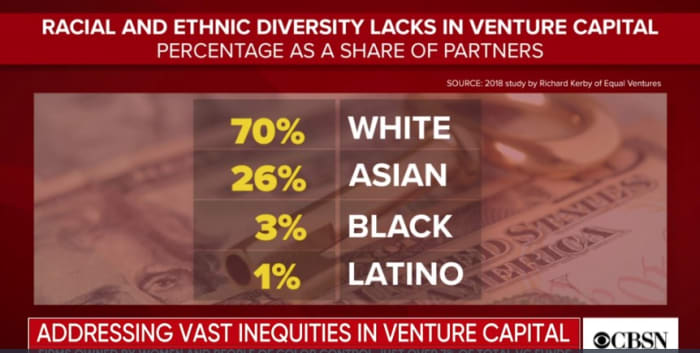

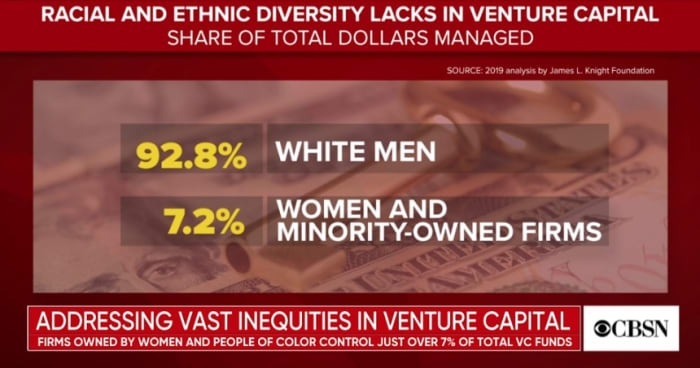

The disparity in investment and representation for minorities in the venture capital space is alarming. In 2019, Richard Kerbay of Equal Ventures reported Blacks and Latino comprise of only 4% of VC partners. Also, approximately 93% of venture capital firms are led by white men compared to 7.2% headed by women/minorities. Staggering figures explain the inequities and frustrations minorities face approaching venture capitalists.

Front Office Sports lists Airbnb, Epic Games, Turo, NoBull, Automattic, and ZenWtr as the current investments for Broad Street Ventures. "Hopefully, we can prop it open for others to follow suit." "We have more power and more leverage when we do this together," said Jenkins to CBS News.

The astute Jenkins remarked, "we want to do is create a vehicle in which athletes have access to:

- What venture capital is and how do you invest, and

- Give them [athletes] a vehicle to do due diligence.

MALCOLM INC.

Jenkins also announced the launch of Malcolm Inc. which is the holding company for his off-the-field business portfolio, philanthropic, and brand partnerships with firms in media, technology, restaurants, real estate, apparel, and education. In essence, his clothing line and venture capital investment fund will be under the Malcolm Inc. umbrella.

According to the Sportico article, Jenkins' portfolio includes "Disrupt Foods, a northeast-based franchise restaurant operation and investment company; E&R Real Estate Group, Jenkins’ real estate investor and developer vehicle; Listen Up Media, the safety’s multimedia production company; and Damari, a custom clothing company that makes men’s and women’s suits. The Malcolm Jenkins Foundation, the star’s philanthropic organization, is serving underprivileged youth."

The Malcolm Jenkins Foundation is creating several programs to address financial literacy with minority communities. Jenkins' mother, Gwendolyn Jenkins, is the President and CEO of the foundation. They announced that the organization opened "1,000 savings accounts for students in Pennsylvania, New Jersey, Ohio and Louisiana as part of its longer-term commitment to help eliminate the racial wealth gap that perpetuates in America." Students will receive a $40.00 initial deposit, five years of financial literacy training and tools, an FDIC-insured savings account, and CASHOLA Card with aa Goalsetter app.

Malcolm Jenkins returned to the New Orleans Saints in 2020 after six seasons and a Super Bowl championship with the Philadelphia Eagles. In 183 career game appearances, Jenkins has 20 interceptions, 105 passes defended, 19 forced fumbles, and 6 touchdowns.

New Orleans signed Jenkins to a 4-year, $32M contract in the 2020 offseason. For the Saints to get under the salary cap, Jenkins restructured his contract and has a base salary of $1.1M and a bonus of $5.1M.