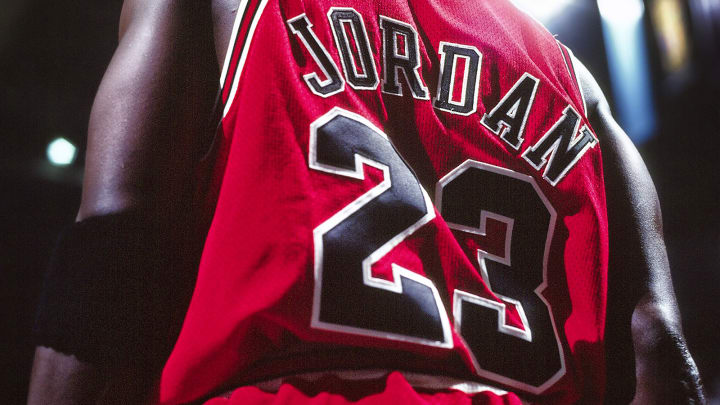

Inside the Rise of Michael Jordan's Unrivaled Marketability

The Last Dance has clarified many points about Michael Jordan. One is his immense, enduring and unrivaled marketability. It’s possible that we’ll never see another athlete with Jordan’s brand power. Sonny Vaccaro, who as a Nike executive signed Jordan in 1984, describes Jordan as transforming an entire industry in ways that have not been seen since. “Michael,” Vaccaro tells Sports Illustrated, “opened every marketing dollar in the world for every future athlete.”

Jordan’s net worth of $2.1 billion reflects a range of wealth sources, including NBA salaries totaling $93.3 million over 15 seasons and his majority ownership interest in the Charlotte Hornets. By the early 1990s, Jordan earned $2.5 million a season in salary from the Bulls. This made him “rich” by any sensible meaning of the word. But it was the commercial value of his name, image and likeness that drove and multiplied his wealth. During the early 1990s, Jordan earned approximately $30 million a year in endorsement deals with Nike, Gatorade, Hanes and other large and established companies. In other words, Jordan earned around 10 to 15 times more in endorsement income than he earned in wages for his labor.

This dynamic was not unique to the early 1990s. Throughout his NBA career, Jordan’s endorsement income far eclipsed his salaries. It played the most instrumental role in Jordan obtaining billionaire status.

Jordan’s massive endorsement earnings have continued long after his retirement. The 57-year-old plays a key role in the management of Jordan Brand, one of nine categories of Nike’s product offerings, the others being Running, Nike Basketball, Football, Men’s Training, Women’s Training, Action Sports, Sportswear and Golf. As observed by Vaccaro and other industry insiders, this close collaboration between an athlete and a major brand is special and unprecedented. With Jordan, the player is less of a company endorser and more of a colleague. For that reason, Vaccaro notes, Jordan “is almost half of Nike [in a relationship where] the employer and employee are partners . . . it’s exceptional.”

According to Forbes, Jordan’s recent one-year take from his association with Nike was worth around $130 million (May 2018 to May 2019). This reflects the incredible staying power of Jordan’s image. Consider that in 2012—nine years after Jordan played in his final NBA game—Air Jordan sneakers, per ESPN, “made up 58 percent of all basketball shoes bought in the U.S. and 77 percent of all kids’ basketball shoes.” All told, Jordan has earned about $1.7 billion off the court, per data compiled by Forbes.

Jordan’s marketability has obviously not occurred in a vacuum. It has reshaped, and enhanced, the marketplace for the NBA and its players. In 1998, Fortune Magazine estimated that Jordan had a $10 billion impact on the U.S. economy. This figure, dubbed “The Jordan Effect,” reflected projections of Jordan’s influence on numerous economic activities. Those projections included Jordan’s role in boosting NBA television ratings and, consequentially, increasing cable and broadcast rights fees paid to the league and shared with players. Jordan is also credited with driving gate receipts to NBA games as well as generating sales of merchandise, apparel and other products. His contributions to films, computer games and video games were also considered.

As the NBA became more popular in the 1990s with Jordan as its centerpiece, the league grew its fan base. Other players became more popular, too. Sneaker and apparel companies became more willing to negotiate massive deals with unproven rookies, hoping that the players would not only develop into superstars on the court but also become marketing machines off of it. In 1996, Reebok signed Allen Iverson, who played two years at Georgetown, to a 10-year, $50 million deal. A year later, Adidas signed Tracy McGrady, who had just completed his senior year at Mount Zion Christian Academy in Durham, North Carolina, to a six-year, $12 million deal. In 2002, Nike inked high school phenom LeBron James to a seven-year contract reportedly worth $77 million, plus a $10 million signing bonus. “Jordan,” Vaccaro reflects, “opened the door for everyone.”

Vaccaro says that sneaker companies have long sought to replicate the special bond between Jordan and Nike with their own player-endorsers, and that pursuit has financially benefited players who followed Jordan. Yet Vaccaro cautions that the pursuit will never land in the same place or capture the same magic. The circumstances that led to Jordan’s ascension with Nike in the 1980s and 1990s can’t be cloned.

“We put it all on the line for Jordan,” Vaccaro recalls. “It was an all-in bet on Michael and Nike was the only company capable of pulling it off.” Vaccaro highlights the creative genius of Air Jordan sneakers and the Jumpman logo working in tandem with Jordan becoming the greatest player of his generation and Jordan and Nike essentially becoming one.

“It can’t be done again.”

Michael McCann is SI’s Legal Analyst. He is also an attorney and Director of the Sports and Entertainment Law Institute at the University of New Hampshire Franklin Pierce School of Law.

Michael McCann is a legal analyst and writer for Sports Illustrated and the founding director of the Sports and Entertainment Law Institute (SELI) at the University of New Hampshire School of Law, where he is also a tenured professor of law.