Why American Needle-NFL is most important case in sports history

On Wednesday, the United States Supreme Court will hear arguably the most important sports law case in U.S. history and one that could dramatically reshape how the NFL and other leagues conduct their business.

The facts of American Needle v. NFL are simple. From the late 1970s to 2000, apparel maker American Needle enjoyed a licensing contract with NFL Properties, a business which controls the NFL's licensing contracts (such as for the use of NFL logos on clothing and in video games). NFL Properties is equally owned by the 32 NFL teams, which share its revenue. Other apparel companies had similar licensing contracts with NFL Properties.

In 2002, NFL Properties signed an exclusive 10-year contract with Reebok for licensed NFL apparel. The contract meant that only Reebok could make NFL-licensed apparel. American Needle argues this contract is illegal under federal antitrust law.

You may be thinking something along the lines of, "Why would this be illegal? So what if NFL Properties decided to go with Reebok and only Reebok? Isn't NFL Properties a private company that can make whatever business decisions it wants to?"

In most cases, private companies enjoy tremendous freedom in their business choices. But NFL Properties -- and the NFL in general -- is not a typical company. It is so unique, in fact, that it often poses problems for courts.

Here's why:

The NFL is comprised of 32 separately owned teams that compete on and off the field. From that vantage point, NFL teams are competitors, rather than one company. And in law, competitors are supposed to compete.

NFL teams, though, must agree on rules. If teams disagreed on the number of points earned by a touchdown, or on the order of the NFL draft, they could not play each other or conduct a draft. Some collaboration is therefore essential. From that vantage point, NFL teams seem more like parts of one company.

NFL teams also agree on rules that promote parity and help to sustain small-market teams. Take the NFL's national television contracts. These contracts equally distribute broadcasting revenue to the 32 NFL teams, even though large-market teams might earn more by negotiating their own TV deals. The logic behind sharing derives largely from former NFL commissioner Pete Rozelle, who persuaded NFL owners that the economic failures of one NFL team would threaten the league as a whole. As franchise values have soared over the last 50 years and as the NFL has become the most successful pro league, Rozelle appears almost prophetic.

This interplay between competition and cooperation underlies the heart of the case. Under federal antitrust law, and specifically Section 1 of the Sherman Act, competitors can generally not conspire in ways that impair competition or harm consumers, be it in terms of increased prices or limited choices. If they conspire, they are subject to Section 1 analysis, which traditionally has regulated the NFL in its business decisions and which balances pro and anticompetitive effects. In various cases, Section 1 analysis has led to the rejection of NFL policies that restricted competition. Those policies included the so-called "Rozelle Rule," which required any NFL team that signed a player to financially compensate the team which previously employed the player, as well as league rules that prevented NFL owners from relocating their franchises without league approval.

Although the NFL can obtain many of its preferred policies through collective bargaining with the NFLPA (since collectively-bargained policies are normally exempt from antitrust law), collective bargaining does not cover every desired policy and even when it covers a policy, the league might prefer to adopt policies without the give-and-take of collective bargaining.

American Needle argues that by agreeing to license only with Reebok, the NFL and its teams -- which have sometimes sued the NFL itself -- are competitors engaged in a Section 1 violation. An exclusive contract for NFL apparel shuts out American Needle and other apparel companies from negotiating with individual NFL teams and it means that Reebok, without competition from other those companies, can charge higher prices.

In response, the NFL offers a legal argument that it hopes will shield the league from Section 1 scrutiny: although the NFL is comprised of separately-owned and competing teams, the NFL is actually a "single entity." As a single entity, it cannot conspire with itself, meaning it cannot violate Section 1, which only regulates multiple entities, since competition requires multiple entities.

So is the NFL and its teams a single entity?

In 1984, the Supreme Court held that single entity status is limited to parent companies and their wholly-owned subsidiaries, a limitation which would clearly not include the NFL and its separately owned franchises. At that time, the Supreme Court reasoned that it would be pointless to prohibit parents and wholly-owned subsidiaries from coordinating activities when the parent calls all of the shots.

The Supreme Court will now assess whether single entity status should extend to the NFL and its teams (and, by implication, similar leagues and their teams). The Court is taking American Needle v. NFL on appeal from the U.S. Court of Appeals for the Seventh Circuit, which held that for purposes of apparel sales the NFL and its teams are a single entity. Other U.S. Courts of Appeals previously rejected the NFL's single entity argument, instead describing NFL teams as part of a joint venture of competitors -- and thus subject to Section 1 analysis.

The Supreme Court could choose one of at least three paths:

1. Affirm the Seventh Circuit and limit single entity recognition to NFL apparel sales.2. Affirm the Seventh Circuit and extend single entity recognition to other NFL business activities.3. Reverse the Seventh Circuit's ruling and require that NFL Properties' exclusive contract with Reebok be subject to Section 1 scrutiny.

Whichever path the Supreme Court chooses, it would likely impact other leagues, including the NBA and NHL, both of which have filed amicus briefs in support of the NFL's position. Depending upon the ruling, leagues may be able to avoid the threat of Section 1 scrutiny when they sign exclusive contracts with sponsors and licensees (meaning we could expect more exclusive contracts with clothing companies and video game publishers, such as the one between the NFL and Electronic Arts), when they utilize league-owned television channels to remove games from free television (think about the NFL Network, which has drawn rebuke from Senator Arlen Specter on antitrust grounds), and when they limit the autonomy of individual franchises (such as the NHL taking over control of teams' Web sites), among many other business pursuits.

Most dramatically, although unlikely given the longstanding legacy of league-labor relations, the Supreme Court could affirm the Seventh Circuit and extend single entity recognition to matters that include those normally subject to collective bargaining, such as players' salaries, free agency rights, and age eligibility restrictions. Leagues could therefore unilaterally restrain players' employment, with players relegated to striking or pursuing job opportunities in leagues abroad as their only means to combat league unilateralism.

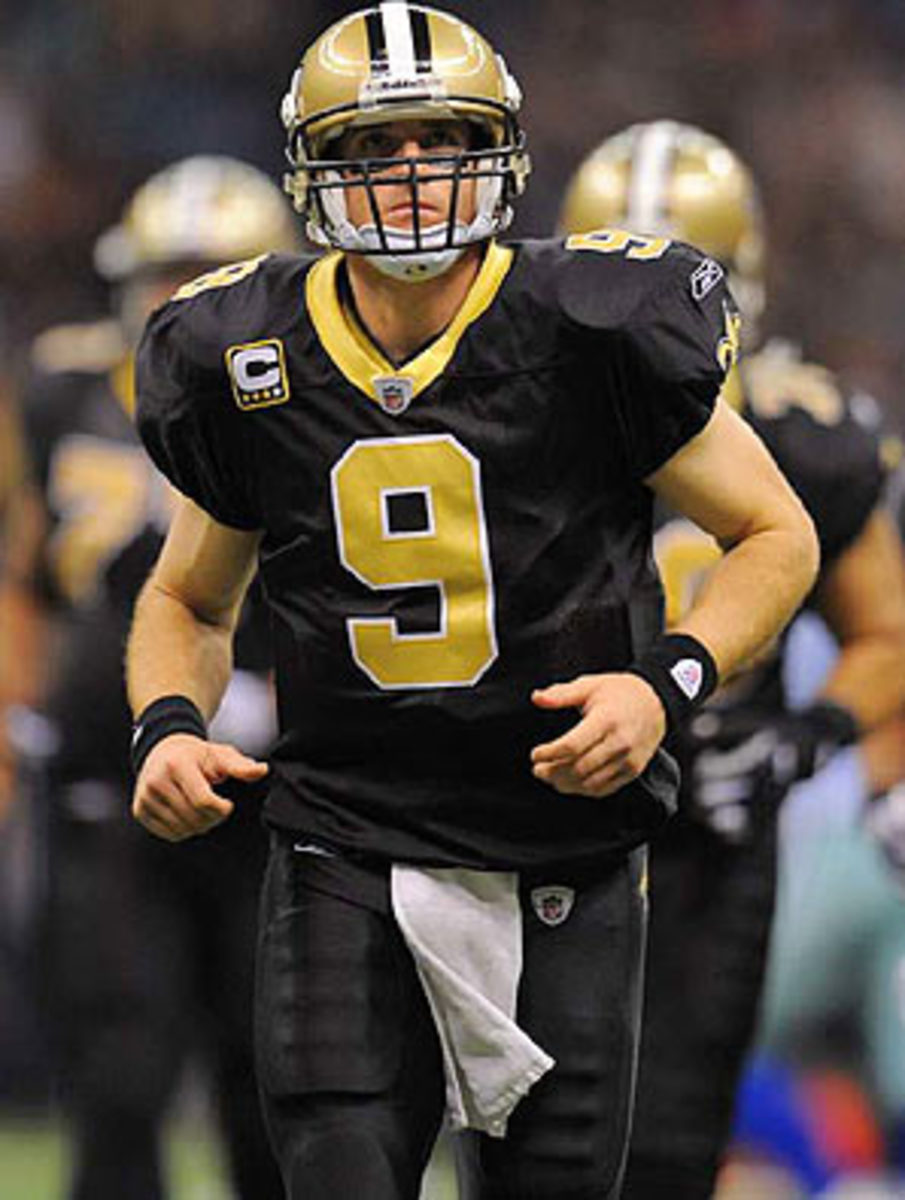

As articulated in a recent op-ed by New Orleans Saints quarterback and NFLPA executive committee member Drew Brees in the Washington Post, that possibility is a real concern to NFL players. Moreover, as Minnesota Vikings offensive lineman and NFLPA player representative Steve Hutchinson told SI.com: "Less than 20 years ago, there was basically no free agency in the NFL. What's interesting is that NFL players and fans won that right via a lawsuit that would not have been possible if the NFL wins the American Needle case. That's a dangerous thing for everyone but the owners of NFL teams."

Even if single entity recognition does not extend to labor matters, any recognition of single entity status could impact collective bargaining and the chances of the NFL and NFLPA agreeing on a new CBA. This is in part why the players' unions in the four major sports (the NFLPA, MLBPA, NBAPA, and NHLPA) have jointly filed an amicus brief opposing the NFL's position.

The Supreme Court's ruling may not end the single entity issue. Congress could hold hearings in 2010 to examine the relationship between antitrust law and professional sports, and that discussion could prompt additional changes in law.