Who really is the NBA's highest-paid player? Analysis reveals it's not Kobe

To take a deep dive into NBA salaries, SI.com partnered with tax expert Robert Raiola (@sportstaxman) to examine how much NBA players really make and what financial challenges they face.

When Joe Johnson signed a six-year, $123.7 million extension with the Hawks in the summer of 2010, it was considered a massive overpayment by Atlanta. Johnson was 29, his per-minute numbers didn’t suggest he was one of the top players in the league and the Hawks had yet to advance beyond the conference semifinals during his five seasons with the team.

Johnson has been unable to shed his “overpaid” label ever since, even after emerging as a reliable scorer with the Nets following a 2012 trade. One can debate whether Johnson’s production has trended closer to his price tag in recent years, but the general perception – one forged before he ever suited up in Brooklyn – is that he’s an untradeable, cap-sheet albatross. Grantland’s Bill Simmons rated Johnson’s contract the worst in the league last year, while The New York Times last month described Johnson as “among the game’s most overpaid players”

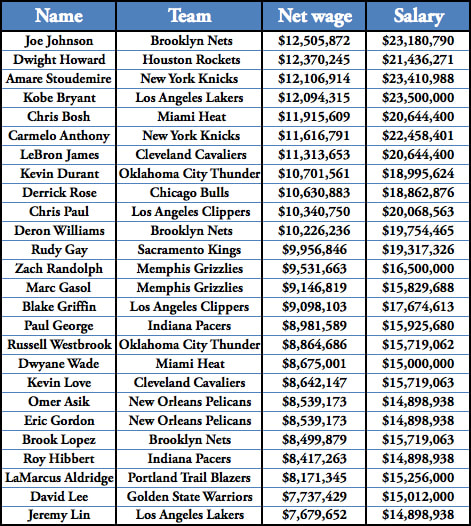

Salary is the main talking point for Johnson and other players perceived to provide little bang for their buck. But Johnson’s true earnings differ considerably from the figure reported in that 2010 deal. Johnson comes in at No. 3 in the league when ranked according to yearly salary, behind the Lakers’ Kobe Bryant and the Knicks’ Amar'e Stoudemire. After adjusting for taxes, however, Joe Cool is the highest-paid player.

What Do the Highest-Paid NBA Players Actually Make? | Create Infographics

SI.com endeavored to determine the net earnings of 25 players at the top of the league’s financial food chain. Federal, state and city taxes all came into play, as well as costs for agents and NBAPA membership. We decided to exclude contract incentives, as they would have further complicated an already fraught exercise. These calculations were not without limitations. To start, there were inconsistencies in salary figures across several databases, but we decided Spotrac.com was the most reliable source.

Another issue was determining the place of residence for certain players. This is a crucial distinction when looking at taxes. Whether a player on one of the New York teams lives within state and/or city lines, for example, could make a significant difference on his true (post-tax) earnings. But a player owning a house in New York isn’t necessarily a telltale sign that he is taxed as a New York resident.

• Play FanNation's new NBA games:Fast Break | BasketballThrowdown

People whose permanent home is not in New York – or are not “domiciled” there, in NY tax code parlance – are deemed residents if they maintain a permanent place of abode in the state and spend at least 183 days of the taxable year there (or qualify as “statutory residents”). An additional tax is imposed for city dwellers using the same criteria. With travel for road games and other offseason excursions, figuring out whether players meet that and other thresholds can be tricky. Intel from league sources helped reduce our margin for error.

Twenty-two NBA teams are based in states that enforce income taxes and four teams play in cities with income taxes. Another layer of complication comes from the so-called “jock tax,” a calculation based on “duty days” or games played. Players can be taxed for visiting various cities and states during road trips.

In Ohio, where lawsuits brought by former Bears linebacker Hunter Hillenmeyer and former Colts center Jeff Saturday are currently pending in the state Supreme Court, professional athletes and entertainers, unlike other workers who visit the state, are targeted as "easy-to-identify, high-end source(s) of revenue." While there’s no jock tax in Tennessee, NBA players must pay a $2,500-per-game occupational privilege tax with a three-game cap per year. An exemption already made for NHL players in the state will be extended to NBA players in June 2016. NFL players have never been subjected to this tax.

As noted above, this is not a foolproof ranking. These calculations were done with the understanding that perfection was a virtual impossibility. Consider this a general assessment of how the NBA’s highest paid players’ gross earnings differ from their real (after tax) earnings.

It’s also worth pointing out that these figures could spike across the board over the next couple of years as the salary cap increases to accommodate an influx of revenue from the league’s new television deal.

The two-year, $48.5 million extension Kobe Bryant signed last November has undoubtedly hampered the Lakers’ rebuilding plans, but consider that LeBron James, who signed a two-year, $42.1 million contract with Cleveland this summer, could be set to land a five-year, max deal with an annual value north of 30 million in 2016-17, depending on how the league decides to phase in the new dough. Of course, some of that will go to Uncle Sam, state and local governments, but with teams better equipped to splurge on stars, this ranking could look completely different in the league’s new financial landscape.

Here are a few more observations from the data:

• The Nets are the only team in this analysis that includes three players. At first glance, there’s nothing particularly surprising about the presence of three of the league’s top net earners on a team whose majority owner dismisses $144 million in reported losses by saying “It’s not a big deal […]” What’s interesting is that the one player here who has even come close to living up to his deal is Johnson, the league’s poster child for exorbitant contract values. Whereas Johnson has developed into one of the league’s more imposing wing threats, the bounty exchanged for Williams – Devin Harris, Derrick Favors, two first-round picks and cash – is one of the biggest reasons the Nets find themselves in financial dire straits. Of course, it would help if Williams and Lopez could stay healthy.

• The reaction to Bryant’s extension was similar – if more vehement – to the one that met Johnson’s 2010 deal. Thanks to California’s harsh income tax, Bryant, who commands the league’s highest annual salary at $23.5 million, falls to No. 4 in terms of net wages. It follows that the five other players in this study who belong to teams that play in California (Jeremy Lin (Lakers); Blake Griffin and Chris Paul (Clippers); David Lee (Warriors); and Rudy Gay (Kings) top the list of percentage of salary deducted due to tax. To put that into context, California collected a whopping $216.8 million in tax revenue from professional athletes in 2012. Meanwhile, Dwight Howard, who left money on the table in Los Angeles to join the Rockets in July 2013, benefits handsomely from living in Texas, a non-taxing jurisdiction. Though he pays a jock tax for some road games, Howard is three spots higher (No. 2) on our net wages list than the gross salary list (No. 5).

• Who are the best players not included in this analysis? Here are 10, in no particular order: Stephen Curry (Warriors), Anthony Davis (Pelicans), Damian Lillard (Blazers), Tony Parker (Spurs), Tim Duncan (Spurs), James Harden (Rockets), John Wall (Wizards), Dirk Nowitzki (Mavericks), Kyrie Irving (Cavaliers) and DeMarcus Cousins (Kings). Harden signed a five-year, $80 million max extension with the Rockets after being traded from the Thunder on the heels of his 2011-12 Sixth Man of the Year campaign. He’ll ascend into the top 25 assuming he signs another max contract with Houston before or at the end of his current deal, which runs through the 2017-2018 season. Harden would be entitled to earn more under the new deal because of his experience. Like Rockets-teammate Howard, his placement on a future net wages list would likely be higher than it is on the salary list. The other Texas-based players mentioned (Nowitzki, Duncan, Parker) are unlikely to crack the top 25 before retiring.

• The Bulls, Lakers and Mavericks were among the teams that courted Carmelo Anthony in free agency this summer. After a high-profile, cross-country tour, Anthony ultimately elected to remain in New York, where he’s set to lose more than 48 percent of his salary to taxes this year. Before Anthony made his decision, SI.com looked into how much he would have earned on other teams. Had Anthony chosen to sign with Chicago – the most serious competitor to New York, according to reports – on an estimated four-year, $95.9 million contract, his net salary in 2014 projected to be approximately $12.5 million. After signing a more lucrative deal (reportedly more than $122 million, but less than the $129 million max, over five years) with the Knicks this offseason, Anthony is set to pull in a projected $11.6 million.