Noah Syndergaard's Signing Signals an Active Market for Starters

As of a few weeks ago, it was not hard to find a prediction about the free agency market that went something like this: With a work stoppage widely expected once MLB’s collective bargaining agreement expires on Dec. 1, there would be little significant movement in November, as teams and top players alike waited to see what the new economic structure of the game might hold. There’d still be activity around the margins—backup catchers, fourth outfielders, those small moves would likely happen as usual through November. But major free agents? It stood to reason that baseball would probably have to wait until January. (Or February. Or … well, hopefully not March, or beyond, but who was to say?)

It hasn’t played out quite like that. But you probably knew that already: There’s been some significant movement from starting pitchers scarcely halfway through November. Eduardo Rodríguez reportedly signed a five-year, $77-million deal with the Tigers on Monday. Noah Syndergaard eschewed a qualifying offer from the Mets to take a one-year, $21-million contract from the Angels on Tuesday. Throw in one earlier, less notable free-agent signing (the Dodgers’ one-year, $8.5-million bet on Andrew Heaney) plus a seven-year, $131-million extension for Blue Jays righty José Berríos, and you have a fairly strong picture of what the market is looking like for starting pitching. And still more than a week before Thanksgiving!

The most surprising of those deals—and, by extension, the most telling—is Syndergaard’s. The 29-year-old has pitched just two innings in the last two seasons. After undergoing Tommy John surgery when spring training shut down in 2020, he went through a lengthy recovery, coming back for the aforementioned two innings only in the last regular-season games of 2021. And his last full season before the injury had been dotted with issues, too: 2019 had been the worst year of his career to date, with his previously deadly slider losing some of its velocity and getting shelved as a result, which contributed to a 4.28 ERA and 96 ERA+. (It was the first season where Syndergaard had been statistically below average.) All of which is to say: Syndergaard was not entering free agency at an ideal time for him. When the Mets tagged him with the one-year, $18.4 million qualifying offer, it seemed from the outside that it would make quite a lot of sense to take it.

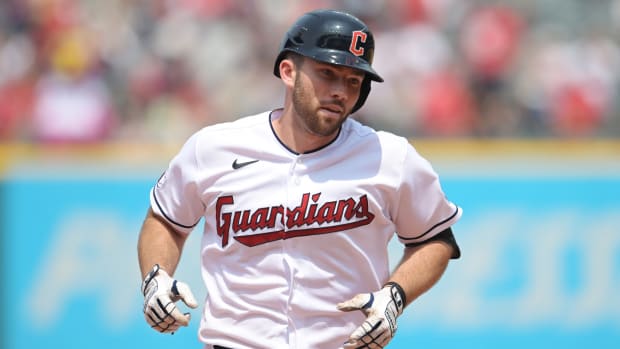

Mets pitcher Noah Syndergaard spurned the Mets' qualifying offer to sign with the Angels for a reported $21 million deal.

Steve Mitchell/USA TODAY Sports

What Syndergaard needed was a chance to prove he was healthy and could pitch like he had earlier in his career. The qualifying offer would give him just that: The one-year deal is an ideal pillow contract for a situation like this. (It helped, too, that he had previously been vocal about an interest in staying with the Mets—Syndergaard could take the opportunity to build himself back up in the organization where he had spent his whole major-league career.) Add in the fact that players have just 10 days to decide whether they want to accept the QO—not much time to gauge market conditions!—and it just made sense to take the offer.

So what would Syndergaard require not to take the QO? It would probably take a pitching market that had already started moving a bit, with at least one front office who was confident that other starters might ultimately prove so expensive that it made sense to lock in Syndergaard, even with his lack of recent performance, for more than the offer’s $18.4 million.

That’s exactly what happened.

The Angels have a lot of work to do on their pitching staff: They entered this winter needing to add multiple established starters. If there was any idea that the labor uncertainty would yield a situation where teams could find discounts, Heaney’s and Rodríguez’s deals put that to rest by mid-November. There were clearly healthy deals happening in the middle of the market—not just at the top. If the Angels wanted to respond by making a gamble on a pitcher whom they believed had strong upside, Syndergaard was a clear option for 2022.

Does that mean the rest of the pitching market is going to be an out-and-out, big-dollar bonanza? No. This was one team making one judgment… and the team was the Angels, which is, well, historically not the most accurate barometer of anything regarding pitching judgment. It’s fair to say that GM Perry Minasian & Co. are operating with a sense of urgency, given the desire to build around Shohei Ohtani and Mike Trout, and even some desperation, given the state of their rotation. (A team doesn’t put together a draft class made entirely of pitchers if it isn’t operating with at least a little desperation around its pitching.) So, no, there may not have been many (or any) other teams who would have wanted to pay Syndergaard above the QO.

Yet all that the starter needed was one—and it’s a hint about how the pitching market is viewed by, at least, the Angels. And even if they were the only team ready to jump above $20 million for Syndergaard, given the other action that baseball has seen so far this winter, they weren’t the only one to sense that the market for starters remains competitive.

It’s an exciting start to November. Even if the action grinds to a halt in December—this should offer a much better idea for what to expect when it begins again.

More MLB Coverage:

• Rankings and Predictions for MLB's Top 50 Free Agents

• Tigers State Their Intent With a Savvy Signing

• Philadelphia Failure to Giant Success: Inside Gabe Kapler's Transformation

• Relief Pitching Is Out of Control

• Astros Couldn't Silence the Naysayers—and Never Will